According to the Q1 2025 US Energy Storage Monitor from Wood Mackenzie Power & Renewables and the American Clean Power Association (ACP), the US energy storage market set a new record in 2024.

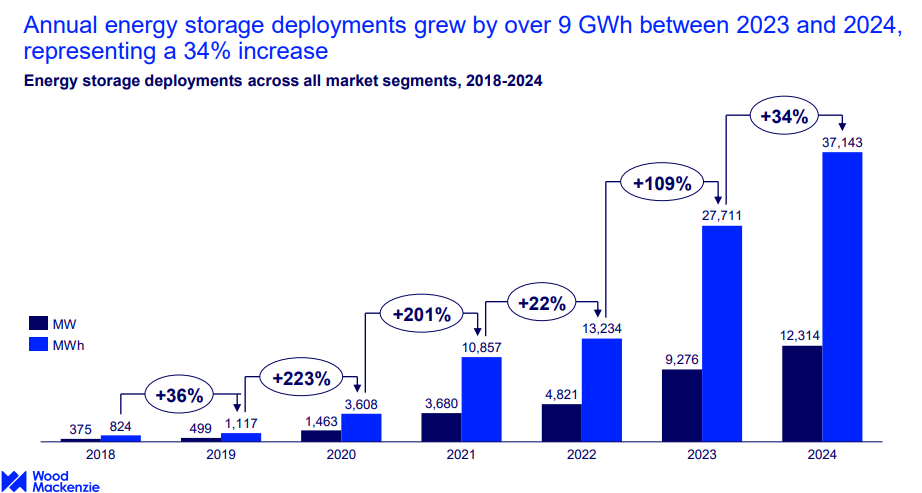

Energy storage installations surpassed 12GW in 2024, with a total of 12,314MW and 37,143MWh deployed. These numbers represent increases of 33% and 34% over 2023.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Utility-Scale deployments enter ‘new phase of growth’

Q4 grid-scale deployments were down 20% compared to Q4 2023. ACP says this is primarily due to the delay of 2GW of projects in late-stage development from Q4 2024 to 2025.

The report shows that the utility-scale segment added 3,336MW/9,499MWh during Q4 2024. An impressive, though predictable 61% of that was installed in Texas and California.

Texas led energy storage installations with 1,185MW, California installed 857MW. While the two states led the way in energy storage installations, they saw a 30% reduction from Q3.

The other 39% for Q4 2024 was installed in New Mexico, Oregon, Arizona, North Carolina, South Carolina, Georgia, Idaho, Alaska, Colorado, New Jersey, Massachusetts, Minnesota and Illinois.

New Mexico, with 400MW, Oregon, with 292MW and North Carolina, with 115MW, were responsible for 30% of the total installations.

Kelsey Hallahan, ACP Sr. Director of Market Intelligence noted:

“Energy storage has entered a new phase of growth with its first year of double-digit deployment. We are increasingly seeing the industry’s growth diversified across geographic regions, with 30% of storage capacity additions in Q4 2024 represented by New Mexico, Oregon, and Arizona.”

Overall, the utility-scale segment shrunk by 1GW compared to Q4 of 2023.

Record-breaking residential storage and a lagging CCI market

The residential storage market saw more than 1,250MW installed in 2024, 57% above 2023 totals.

This includes a ‘record-breaking’ 380MW of residential storage explicitly installed in Q4. This represents a 6% increase over the previous quarter.

Community-scale and commercial and industrial (CCI) installations saw a 22% increase from the previous year, with 145MW installed capacity.

88% of installed CCI capacity was spread over California, Massachusetts and New York.

While the CCI segment had a noteworthy Q4, 2024 still lagged behind 181MW of CCI storage installed in 2021.

Even higher installs expected in 2025, though policy uncertainty looms

Wood Mackenzie forecasts that across all segments, 15GW/48GWh are expected to be installed in 2025, representing a 7% increase over last quarter’s 2025 forecast.

The market research firm says its base case estimates that nearly 12GW of residential storage will be deployed by the decade’s end.

Attachment rates are generally expected to increase year over year at a state level, but the national attachment rate is expected to decrease due to a lower detachment rate in solar in markets with net metering.

Its base case has the CCI market growing 3x by 2029 but says that this is highly dependent on federal and state policy.

There are also unknown impacts coming from the Trump-Vance administration, with Wood Mackenzie saying its low case reflects a 9.7GW decrease in storage installs.

The future of the Inflation Reduction Act (IRA) and its tax incentives leaves many questions unanswered.

The high case assumes that federal clean energy tax credits are not changed, additional tariffs do not materialise, renewables with storage are deployed and barriers to both financing and interconnection are eased.

In this case, results are forecasted be an extra 10GW installed over the next 5 years.

The low case assumes a phase-out of the tax beginning in 2028, increased protectionist measures that raise the price of Chinese systems, expanded gas supply chain, preferential gas interconnection and increased barriers to financing and interconnection.

In this scenario, installs are reduced 22% in total from 2025-2029.

Allison Weis, global head of storage for Wood Mackenzie said of the coming year:

“The combination of new tariffs on China and other countries with continued 45x and domestic content bonus adder incentives would make US-based systems more competitively priced.”

“However, many domestic providers are not set up to meet quick demand. If higher pricing is combined with ITC tax incentives phasing out beginning in 2028, it could lower our five-year deployment outlook by as much as 19%.”

Concerns over the future of the IRA’s tax credits have been increasing. Recently, Energy-Storage.news spoke with Clean Energy Associates’ senior policy analyst Christian Roselund (Premium access article), who said:

“Everything is still highly uncertain, but our base case is that there is a phase-out of the 48E ITC and the 45Y PTC overall as of the end of 2025. Those are the technology neutral tax credits for projects that begin construction on or after 1 January, 2025.”

Procurement platform Anza Renewables also noted that tariffs will continue to shape pricing strategies in its first quarterly US energy storage pricing insights report covering battery cell pricing, AC and DC-integrated systems, list prices and more.

This latest report from Wood Mackenzie tracks with its predictions from the Q3 2024 report, wherein the firm noted that across all segments, 2024 is expected to see a total 11.9GW/34.4GWh of energy storage deployed.