Charlotte Gisbourne of Solar Media Market Research looks at the patterns of regional disparities in the UK grid-scale BESS market.

With over 9GWh of operational grid-scale BESS (battery energy storage system) capacity in the UK—and a strong pipeline—it’s worth identifying the regional hot spots and how the landscape may evolve in the future.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

This article shows the regional divide of energy storage in the UK, delving into both operational capacity and the pipeline. Our data shows that three different regions lead for operational capacity, under-construction capacity and submitted capacity respectively.

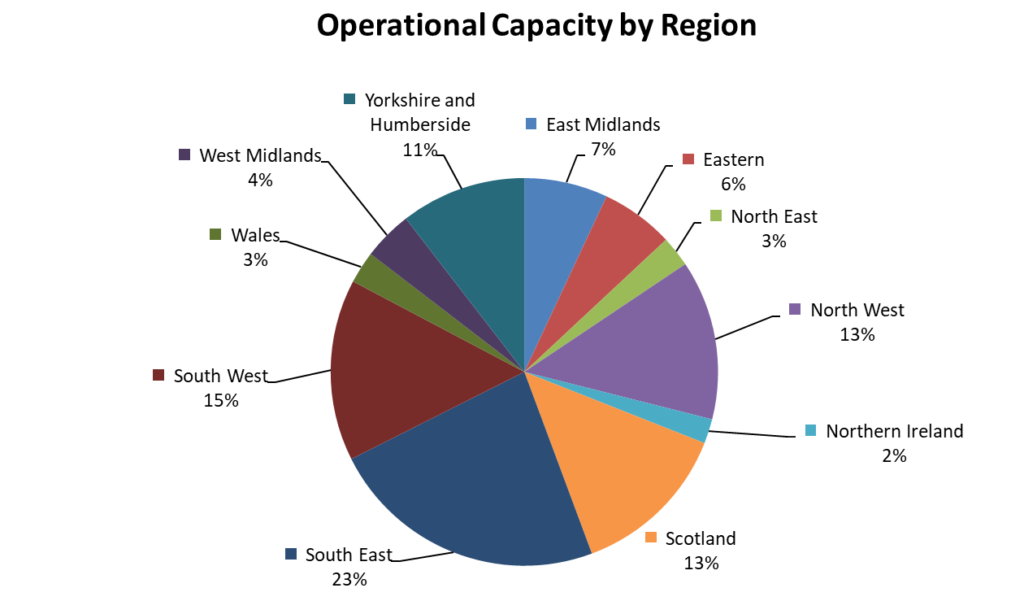

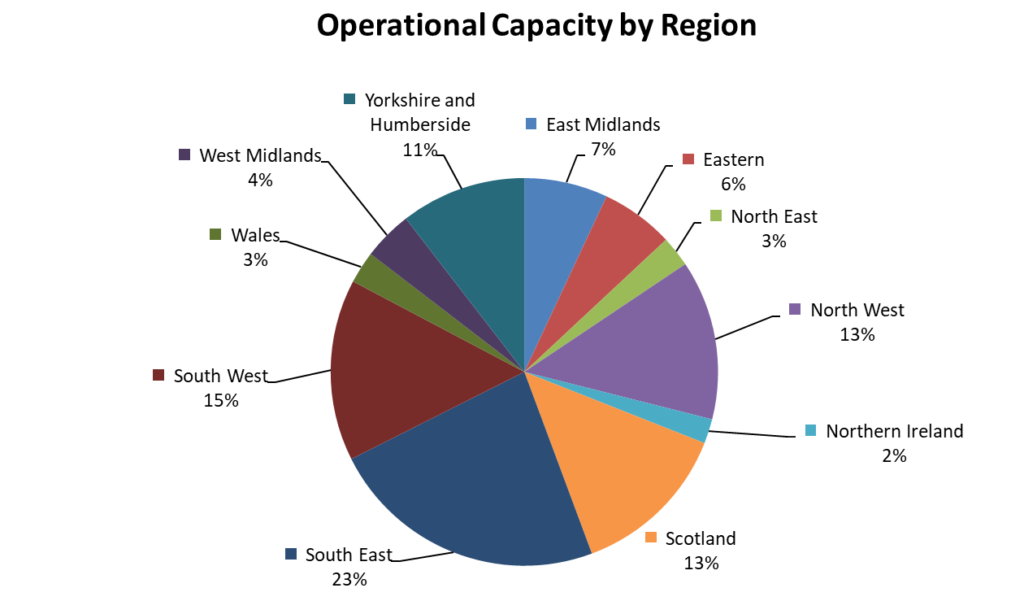

Operational capacity by region in the UK

The South East of England leads the way with both the highest operational capacity, currently over 2GWh, and the most completed BESS sites in the UK. This region has maintained the top position across the UK since 2021, moving ahead of other areas in 2023 where it had 33% of newly built capacity built that year.

Scotland is seeing strong build-out growth, with the cumulative operational capacity increasing over 300% since 2022. The region overtook the North West of England this year as the region with the third highest cumulative capacity, aided by the completion of Zenobe’s 200MW Blackhillock project.

Figure 1: Operational capacity of BESS in the UK is concentrated in the top five regions, making up over 75%.

In contrast, Northern Ireland is still seeing sluggish growth in completed sites. The highest capacity completed in a single year for Northern Ireland was in 2021 at over 80MWh; however, construction on projects seems to have slowed since.

Scotland has the highest average capacity of completed sites, at 52MWh, and the North East of England has the lowest with 17MWh. The West Midlands has the highest percentage of co-located sites, with 60% of completed projects co-located, nearly double the overall proportion of completed co-located sites in the UK of around 33%. These sites in the West Midlands are predominantly on solar farms built before 2020.

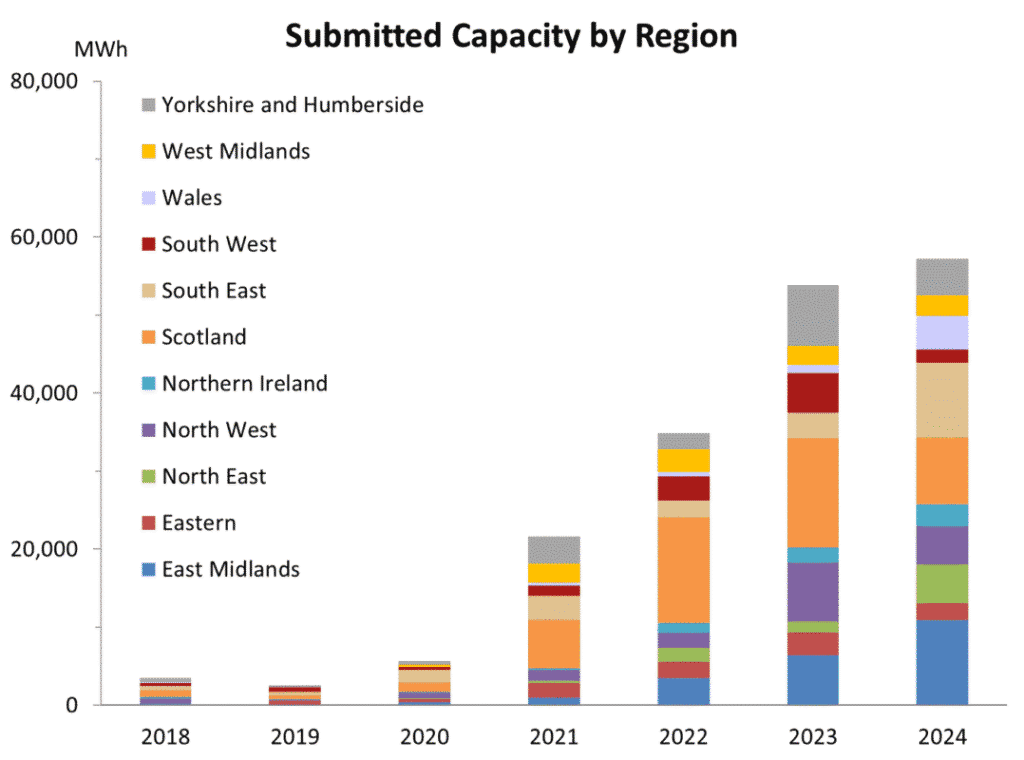

Capacity submissions across the UK

Figure 2: Leading regions for submitted capacity of BESS projects in the UK started to grow strongly in 2021, with Scotland taking the top spot until 2024.

Before 2021, there was a roughly-equal split between submitted capacity in each region, likely due to the UK energy storage market still being in the early stages of growth. Over time, Scotland has become one of the most promising regions for future BESS projects. However, last year Scotland’s share of submitted capacity fell to 15% from the 26% share in 2023, whereas the South East of England managed to rise from 6% to 17%.

There is over 120GWh of BESS capacity in Scotland’s pipeline, although 60% is at the pre-application stage. When ignoring the pre-application sites—and focusing on projects that are likely to be completed sooner—Scotland still has the highest capacity by region in its pipeline at over 47GWh. The region also had the most approvals last year at over 8GWh.

In England, the region with the largest pipeline (excluding pre-application capacity) is the East Midlands at over 20GWh. The region has shown steady growth over the years, with the share of submitted capacity increasing since 2021 and last year had over 10.5GWh submitted to planning. This strong increase in the East Midlands was driven by a high number of sites submitted with more than 1GWh capacity, which has helped the region towards the highest average capacity of pipeline projects at 202MWh.

29% of capacity under construction in England is in the West Midlands. This is helped by the large projects in development here, such as Penso Power’s Hams Hall Battery and Atlantic Green’s Cellarhead energy storage project.

Looking at the Transmission Entry Capacity (TEC) register is also a useful way to gauge when projects may come online. However, not all completed sites will be connected to the transmission system; currently only 42% of operational capacity in the UK are on the register.

However, there are advantages of being connected to the transmission network such as a more reliable connection. Indeed, even more battery projects are being added to the TEC register each month, resulting in the queue increasing. 84% of capacity under construction (and 52% of sites) has been added.

According to the TEC register, over 3GW of standalone battery storage projects are due to be connected in 2025, but nearly 75% of the total is due for connection after 2030.

Overall, regardless of where a site is located, a general trend in the UK is the move towards larger project sizes. The average capacity of projects under construction is 203MWh. This marks a large increase in the average size of BESS completed in 2024, at just 69MWh. There seems to be more emphasis on transmission connected projects as well; although with the long queue, it is likely that these projects won’t see completion for several years.

All data and analysis shown in this article comes from our in-house market research activities, specifically our UK Pipeline & Completed Assets Database.