Clean energy trade body American Clean Power Association (ACP) has released a report on energy storage market reforms for regional grid operators based on findings from the Brattle Group.

The reforms here are specifically targeted toward the PJM interconnection, Midcontinent Independent System Operator (MISO) and the New York Independent System Operator (NYISO).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The ‘Energy Storage Market Reform Roadmap’ looks to the examples of the Electric Reliability Council of Texas (ERCOT) and the California Independent System Operator (CAISO).

During the summer of 2024, Texas saw a historic electricity demand, and energy storage resources saved residents more than US$700 million while keeping the power on.

In California, energy storage reduced the risk of blackouts and brownouts, and the report notes its role in preventing a grid failure in 2022.

Brattle says that energy markets, which have evolved to incorporate more energy storage, are seeing a myriad of benefits from the decision.

Multiple markets in the US could benefit from further incorporating energy storage and the Brattle Group is proposing reforms to do just that.

PJM Reforms

According to Brattle, while storage can participate in PJM’s capacity, energy and ancillary services markets, outdated rules keep it from competing on a ‘level playing field’.

The current rules are designed for traditional generation assets and fail to factor in the opportunity cost of using energy or saving it for a higher-value period.

Opportunity cost is the value of the best alternative use of a forfeited resource.

Brattle says that updating these rules are key for energy storage in PJM. This could be done through ‘opportunity cost bidding’ reform.

This would involve enabling energy storage to include the aforementioned opportunity costs in its bids, which Brattle says would improve market efficiency in five key ways.

- Increased Reliability

- Optimised Dispatch

- Enhanced Market Efficiency

- Greater Flexibility

- Revenue Clarity

‘Day-Ahead Uncertainty Product’ would be a market tool that ensures sufficient availability to meet forecasted net demand.

The tool includes a margin for uncertainty, and Brattle says it would benefit the grid overall by providing needed availability at a lower cost.

PJM also lacks ramping products that can meet real-time flexibility needs. The group points to RTOs MISO, CAISO and SPP, which have implemented ramping products to better manage fluctuations and create a more resilient grid.

Not including ramping products can lead to price volatility, higher uplift costs and an overall less efficient grid.

MISO Reforms

MISO is seeing a rising electricity demand that Brattle believes can be helped with energy storage.

The Brattle Group says in the report that MISO’s annual and peak load is expected to grow an annual 50GWh and 9GW by 2030.

Michigan is planning to build approximately 2.5GW of storage by 2030, and Illinois is looking to target up to 15GW of storage over the next decade.

Still, the region as a whole does lag in deployments when compared to others.

According to the report:

“Since 2019, US energy storage deployment has grown 25x with almost 29GWs now connected to the grid, representing enough capacity to cumulatively power 22 million homes. In 2024, energy storage was the second most deployed resource, yet MISO lags other regional electric grids because of outdated market rules and restrictive modelling practices.”

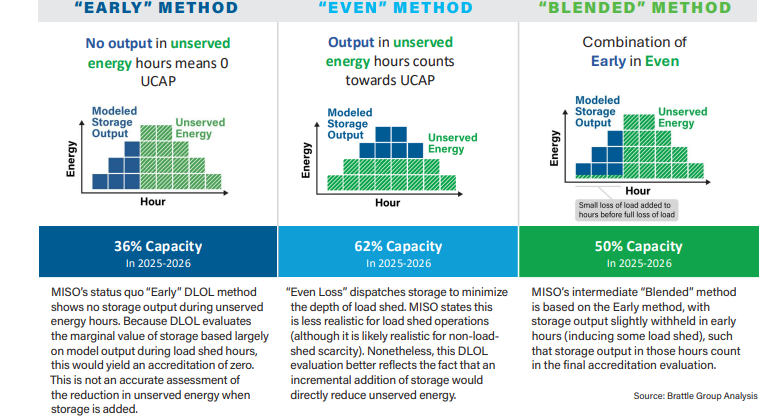

MISO is currently working to reform its Direct Loss of Load (DLOL) methodology and Loss of Load Expectation (LOLE) modelling.

Reforms to the DLOL methodology aim to introduce a probabilistic analysis that evaluates resource performance during high-risk periods rather than averaging risks across a year.

The LOLE metric estimates the probability of power shortfalls over an entire year.

The report claims that the LOLE metric does not fully capture the impact of weather-driven variability, renewables and demand shifts.

It also claims that the DLOL methodology does not fully capture the true reliability contributions of energy storage.

The report clarifies that “MISO can better model and support energy storage deployment using an energy equity or capacity equity approach, as illustrated in the graphs (Shown below).”

“This approach more accurately reflects the real-world performance of storage resources, enhancing grid resilience by aligning planning and resource adequacy requirements with actual system conditions.”

NYISO Reforms

NYISO’s annual and peak load is expected to grow an additional 12GWh and 1GW by 2030.

Like PJM, though, the region’s market structures and rules were designed for traditional generation assets, creating barriers for energy storage.

In NYISO, Brattle also recommends ‘Day Ahead Uncertainty’ and ‘Ramp & Uncertainty’ products.

A ‘Day Ahead Uncertainty’ product would ensure sufficient resources are available on the next day to meet net demand forecasts and include a margin for uncertainty.

Enhancements to the current design would include increasing the operating reserve demand curve maximum value above the current US$750/MWh threshold. This would more accurately reflect system value in scarcity conditions.

Additionally, reforms would include addressing the need for availability to meet day-ahead forecasts for net demand.

A ‘Ramp & Uncertainty’ product would benefit the grid by quickly responding to short-term load changes.

Reforms here would mean including expected ramp in market procurement and increasing the maximum demand curve value above the US$40/MWh threshold to reflect the system value of incremental reserves during high up-ramps, which deplete available reserves.

The report including executive summary is posted on ACP’s website.