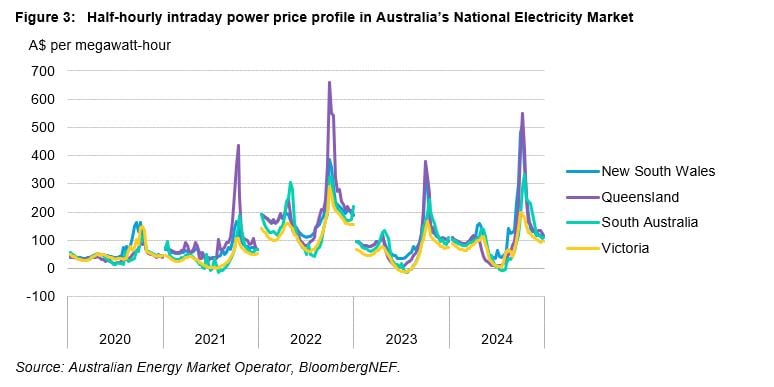

Research provider BloombergNEF (BNEF) has found that utility-scale battery energy storage system (BESS) uptake in Australia could increase eightfold to 18GW in 2035, up from 2.3GW in 2024.

According to BNEF’s 2025 Australia Energy Storage Update, Australia could be on the cusp of a “big battery boom” spearheaded by a volatile power market, supportive government policies and the withdrawal of coal-fired power plants.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

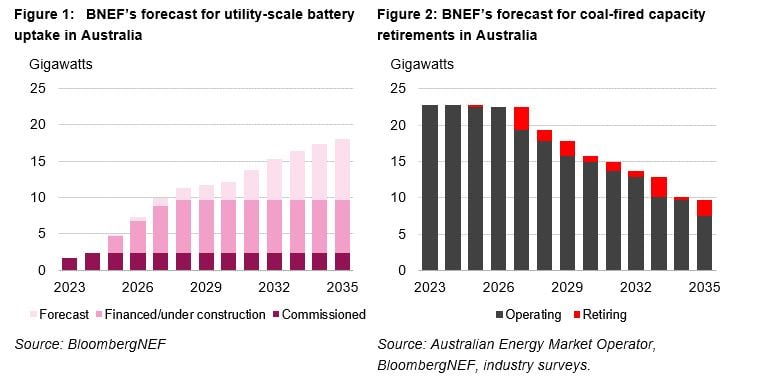

Volatility in the power market has been supported by a rise in variable renewable energy generation connected to the National Electricity Market (NEM), which covers Queensland, New South Wales, South Australia, Victoria, Tasmania, and the Australian Capital Territory.

Wholesale power prices generally decrease when there is a surplus of variable renewable energy generation. When the output from wind and solar is low, more expensive dispatchable generators such as coal and gas increase production, which drives up spot prices.

BNEF said that the exacerbated intraday volatility has created lucrative opportunities for batteries to arbitrage the wholesale spot price by charging when prices are low and discharging when prices rise. Supporting this perspective, the research group found that utility-scale batteries in the NEM earned AU$165.4 million (US$104 million) in revenue from arbitrage in 2024 – a record high and more than triple the revenue earned in 2023.

Similar research conducted by UK-headquartered energy industry data platform Modo Energy in February found that BESS assets in the NEM earned an average of AU$148,000/MW in 2024, a 45% increase year-on-year.

This was primarily driven by a rise in extremely high prices, which led to larger price spreads. The group said that in 2024, the price spread captured by batteries was 72% higher than in 2023.

Negative spot pricing and the withdrawal of coal

The use of variable generation has also led to an increase in negative spot prices, which occur when the supply of electricity temporarily exceeds demand, often in the middle of the day when Australia’s solar PV fleet peaks. In such cases, generators must pay to inject electricity into the grid instead of receiving payment for it.

At the Energy Storage Summit Australia 2025 in Sydney last week, Tim Buckley, founder and director of the think tank Climate Energy Finance, touched on negative pricing events, flipping traditional views and describing them as “an advantage.”

Data from the Australian Energy Market Operator (AEMO) released in January showed that in the fourth quarter of 2024, negative price events occurred 23.1% across the NEM

Mirko Molinari, chief commercial officer (CCO) at renewables and storage developer X-Elio, added to this consideration on a separate panel discussion, saying that hybrid solar-plus-storage projects could capitalise on the negative spot pricing opportunity.

An increase in energy storage deployment is being driven by the withdrawal of Australia’s coal-fired power plants, which is expected to be fully completed as we approach 2040. However, the official date has been debated by Cornwall Insight on our sister site, PV Tech.

BNEF believes that 70% of Australia’s long-dominant coal fleet could retire by 2035, representing an opportunity for BESS to support the transition to clean power. Australia has already seen opportunistic organisations looking to capitalise on the withdrawal of coal-fired plants by replacing them with energy storage systems. This is the case for one of Australia’s largest utility-scale BESS located at Origin Energy’s Eraring black coal-fired power station.

Batteries to play a ‘major role regardless of the federal election’

Australia is heading towards a federal election, with Australian Prime Minister Anthony Albanese announcing today (28 March) that the election will take place on 3 May 2025.

Anthony Albanese of the Labor Party will face Peter Dutton of the Liberal Party of Australia in the upcoming election, and energy policy is set to play a central role in party manifestos.

Since Albanese took office in 2022, the country has seen vast support for renewable energy developments and energy storage through various mechanisms introduced, such as the often-oversubscribed Capacity Investment Scheme (CIS).

BNEF said that so far, at least 3.9GW of battery capacity has received some form of revenue underwriting support from federal or state governments in Australia. However, the future of government programmes like the CIS could hinge on the results of the upcoming election against climate sceptic Peter Dutton.

Dutton has outlined his intention to reduce the Australian public’s energy bills by focusing more on oil and gas, coal-fired power, and nuclear reactors. In the process, he would controversially look to lift a ban on nuclear power that has been in place since 1983 via the Nuclear Activities (Prohibitions) Act.

Despite this, Sahaj Sood, BNEF Australia senior associate and author of the report, said the election outcome is not likely to impact energy storage support, with the technology “expected to play a major role in Australia’s power markets regardless of the outcome of the federal election.”

“The election is set to be a referendum on Australia’s pathway to a low-carbon power sector,” Sood said.

“A win for the incumbent Labor Party would see continued support for renewables and the batteries to integrate them. A win for the Coalition would see the emphasis shift toward nuclear, a potential lifeline for some of the country’s ageing coal fleet.

“Either way, batteries will be required to balance Australia’s volatile power markets by shifting power from times of low demand and high supply to times of high demand and low supply,” Sood concluded.