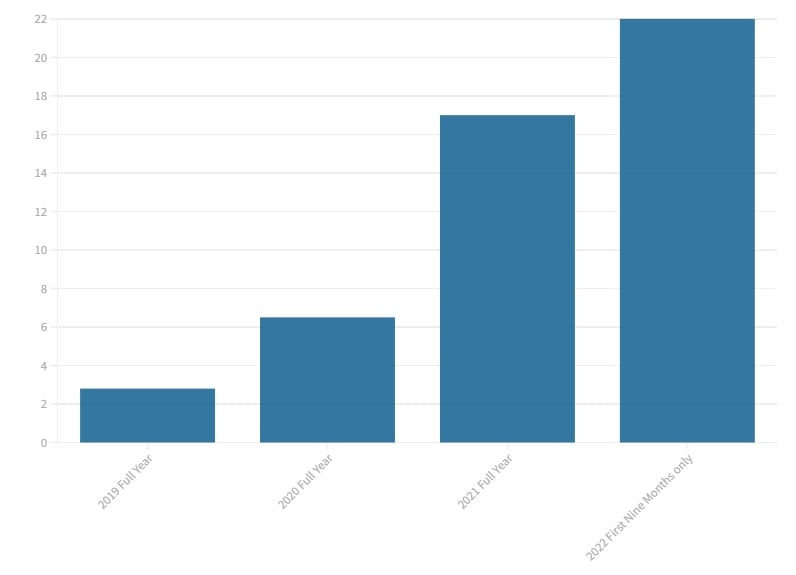

More money was raised through corporate funding for energy storage companies in the first nine months of 2022 than in the entirety of last year, according to Mercom Capital.

The group’s latest quarterly report tracking corporate, VC funding and M&A activity in the sector – along with smart grid and energy efficiency companies – found that US$22 billion corporate funding went in from January to September from 92 deals.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

This was against a total US$17 billion for 2021, while by the end of the same nine-month period last year, that stood at US$13 billion.

As of the half-year mark at the of June, Mercom had tracked US$15.8 billion corporate funding – including public market and debt financing, meaning that between July and September alone the sector had raised US$6.2 billion.

While booming corporate funding may well reflect a maturing market, conversely the amount of venture capital funding in the sector fell considerably year-on-year.

Mercom found that US$4 billion was invested by VCs in the nine months to September, 44% less than was invested in the same period of 2021. That said, there were a greater number of deals this time out, 73 deals versus 60 deals last year.

Top ranked corporate funding deals could swap around before end of year

Mercom ranked the top corporate funding recipients so far this year, and Eolian, an investor and owner-operator of US energy storage assets was top of its list, for the US$925 million funding it closed in April from financiers including Banco Santander, MUFG and Mizuho. The company is in the portfolio of sustainable infrastructure and impact investor Global Impact Partners.

Group 14, a materials company developing technologies for next generation lithium-silicon batteries came in second, with US$400 million raised in a Series C funding round. Investors included Porsche and OMERS Capital Markets.

Incidentally, the company was among recent awardees of grants from the US government to support the domestic battery value chain, with Group 14 getting a US$100 million commitment from the Biden-Harris Administration.

Third was Hydrostor, the Canadian advanced compressed air energy storage (A-CAES) company which claims its proprietary technology has considerably higher round trip efficiency, and fewer heating-based emissions, than legacy compressed air plants.

Hydrostor raised a US$250 million conditional investment commitment from Goldman Sachs toward the beginning of this year. A few days ago, the Australian Renewable Energy Agency (ARENA) pledged to support the company’s planned 1.6GWh project in New South Wales with AU$45 million (US$28.42 million) funding.

Looking ahead, a couple of big deals have been announced since September which could make for interesting reading in the next edition.

Top of the pile is Form Energy, the iron-air battery startup aiming to commercialise a technology that it claims could provide days of low-cost energy storage using abundant and easily assembled materials.

Form raised US$450 million in a Series E funding round, as reported by Energy-Storage.news earlier this month, bringing the company’s total investment raised to date to US$800 million. Investors included ArcellorMittal, Canada Pension Plan Investment Board and Bill Gates’ Breakthrough Energy Ventures.

Earlier this week, a new development company focusing on battery storage projects in the US launched with at least US$200 million backing. Nightpeak Energy has been launched by former executives and directors at Recurrent Energy, the US solar PV and storage developer subsidiary of Canadian Solar.

Mercom also noted that 23 mergers and acquisition (M&A) deals happened in the first nine months of this year, up from 15 in January to September 2021.

With the likes of BloombergNEF having identified that the US’ Inflation Reduction Act (IRA) legislation and Europe’s REPowerEU policy strategy will be likely drivers of an enormous uptick in energy storage deployments in the coming years, it would perhaps not be surprising to see more big deals ring through before the end of the year.