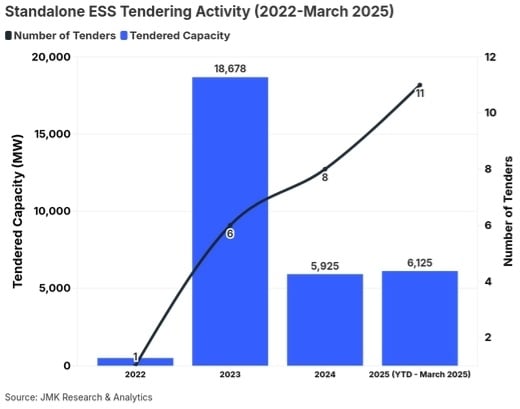

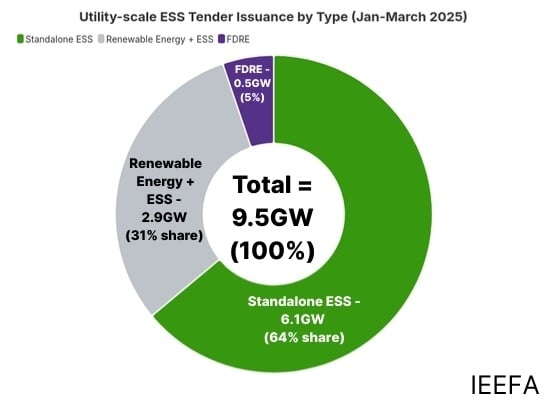

National and regional agencies in India tendered for 9.5GW of utility-scale energy storage in the first quarter of 2025, with more than two-thirds for standalone systems.

According to a new report from JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA), tenders for standalone energy storage systems (ESS) comprised 64% (6.1GW) of the total capacity put out to competitive solicitation between January and March of this year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Meanwhile, 31%, or 2.9GW, was tendered for variable renewable energy (VRE) hybrid or co-located energy storage and the remaining 5%, or 0.5GW, as Firm and Dispatchable Renewable Energy (FDRE) procurements.

JMK Research and IEEFA’s report, ‘The standalone energy storage market in India’, focuses on utility-scale activity for grid-connected systems installed separately and operated independently from generation sources.

“Energy storage is integral to renewable integration and grid resilience, and standalone ESS will play a defining role in shaping a reliable and flexible energy system,” IEEFA energy specialist and contributing author Charith Kondra said.

“They operate as flexible, independent assets that can respond to grid requirements rather than generator constraints, offering network stability and optimising energy use.”

Beyond the key takeaway that standalone storage tenders are becoming the “backbone” of tendering and that tender activity in Q1 has already surpassed all of 2024 in gigawatt terms, the report notes dynamics in the market such as the price-lowering impact of the government Viability Gap Funding (VGF) scheme and diversification of major players’ strategies.

It also highlighted, however, that despite this growth in activity, the industry remains nascent and faces significant challenges as it stands at what the authors described as a “critical inflection point”.

6.4GW of awarded tender capacity cancelled

To date, 20 standalone BESS tenders and three pumped hydro energy storage (PHES) tenders have been issued since the first auctions in 2022, comprising 9.33GW of standalone battery storage at 2-hour to 4-hour duration and 19.9GW of PHES at 6-hour to 8-hour duration. Contract periods are 8-12 years for battery storage and 25-40 years for pumped hydro.

Just 0.13GW of BESS projects from those tenders is now operational, with 3.1GW in the pipeline as of March 2025; 4.7GW of tendered pumped hydro is operational with 3.5GW in the development pipeline by the end of Q1.

“A key barrier has been the delay or cancellation of power sale and storage agreements, often triggered by offtakers anticipating further tariff reductions due to falling battery prices,” Pulkit Moudgil, research analyst at JMK and another co-author of the report, said.

According to the researchers’ findings, 6.4GW of awarded capacity has been cancelled due to these “uncertainties,” Moudgil said, including close to 4GW of PHES and 2GW of battery storage, along with a smaller amount of capacity in technology agnostic tenders.

Other challenges identified by the report include the nascent nature of the domestic supply chain, with manufacturing still in its relative infancy compared to, for example, the solar PV sector in India.

Government urged to expand scope, extend VGF scheme

State and central agencies are a major driving force in tender activity, with state-owned power producer NTPC found to be the most active agency, issuing six tenders adding up to 5.75GW of BESS capacity since 2022.

Gujarat Urja Vikas Nigam Limited (GUVNL), responsible for the bulk purchase and sale of electricity in Gujarat and Maharashtra State Electricity Distribution Company Limited (MSEDCL), electricity distributor in Maharashtra are among the most active in issuing tenders at state level. GUVNL has issued five tenders totalling 2GW and MSEDCL has hosted two tenders (3.8GW) for standalone ESS.

As will now be familiar to regular readers of Energy-Storage.news and our solar technology website PV Tech, India is undergoing a major energy transition, targeting 500GW of non-fossil fuel generation by 2030 and net-zero emissions by 2050.

In setting those targets, the Union government recognised the important role energy storage can play in India. The most recent National Electricity Plan and National Transmission Plan published by the Ministry of Power’s Central Electricity Authority (CEA) models a need for 83GW of energy storage by 2032, comprising both battery energy storage system (47GW) and pumped hydro energy storage (nearly 36GW).

In addition to the Production-Linked Incentive (PLI) scheme to subsidise manufacturing investment, the government’s recent introduction of VGF, first announced in 2023, is aimed at supporting 13.2GWh of storage capacity by 2027-2028. It initially awarded 40% of the Capex cost of the project, capped at IR9.6 million/MWh (US$112,281/MWh) through a tariff-based bidding process, with subsequent tranches gradually lowering both the percentage and cap.

According to JMK Research senior consultant Prabhakar Sharma, one of the report’s authors, VGF has significantly reduced the cost of projects in the development pipeline.

“In recent auctions, battery energy storage system tenders in Maharashtra and Rajasthan secured tariffs as low as IR219,000-221,000 per megawatt (MW) a month (US$2,561-US$2,586/MW/month), representing almost a 40% reduction compared with non-VGF projects with similar specifications,” Sharma said.

The report sees that the scope of the VGF scheme is limited, however, only allowing bidding from developers with the participation of intermediaries in six states and runs until FY2028 and until a 13.2GWh overall target is reached. IEEFA and JMK Research urged for the extension of the funding programme as well as increasing eligibility to offtakers including electricity distribution companies (‘Discoms’) and corporate customers.