Lithium iron phosphate (LFP) will be the dominant battery chemistry over nickel manganese cobalt (NMC) by 2028, in a global market of demand exceeding 3,000GWh by 2030.

That’s according to new analysis into the lithium-ion battery manufacturing industry published by Wood Mackenzie Power & Renewables.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

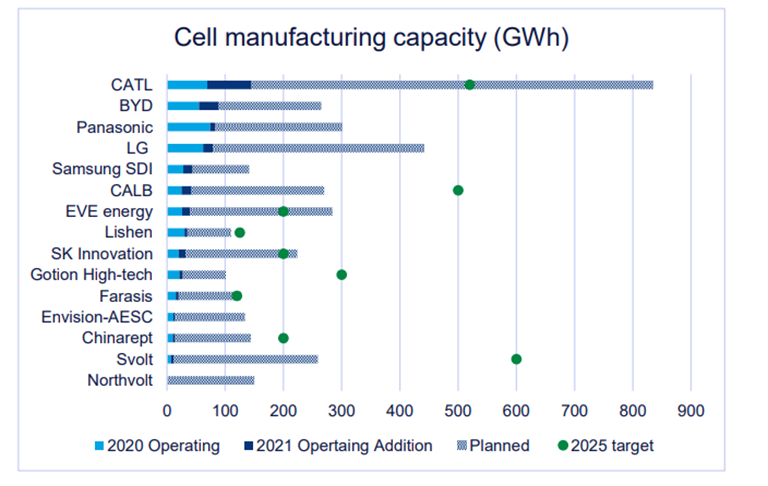

The top two manufacturers planning to add the most production capacity during this decade were China’s CATL and South Korea’s LG.

CATL alone intends to have 800GWh of annual production capacity online by 2030.

The top 15 producers in 2021 alone got 200GWh of new production lines running and by the end of last year cumulative manufacturing capacity reached 600GWh.

China’s manufacturers across the board have announced plans to build more than 3,000GWh of capacity to date. The Asia-Pacific region will therefore continue to lead the market, which globally has announced 5,500GWh of manufacturing capacity to come online by 2030 at 300 facilities, but Europe and the US will have begun to eat into its share by then.

While 90% of the world’s battery manufacturing was in the Asia-Pacific region, and most of that in China, by 2030 that share will have fallen to 69%. Europe will have a 20% share at that stage, Wood Mackenzie forecast.

That forecasting is broadly in line with recent figures from another analysis group, Clean Energy Associates, which said China — as opposed to Wood Mac’s reporting of Asia-Pacific region percentage — had a share of about 75% of global battery cell production capacity in 2020, set to fall to 66% by 2030.

Another group, Benchmark Mineral Intelligence, calculated that Europe is on track for 27 gigafactories by 18 different producers by 2030, accounting for 789.2GWh of capacity by then, a 14% share of the global total market.

‘Skyrocketing demand’

Like Wood Mackenzie, Clean Energy Associates (CEA) noted the competitive dynamic heating up between LFP and NMC batteries. Safety advantages, long lifecycle and lower costs have led to EV makers starting to accept the trade-off of lower energy density in adopting LFP batteries, both firms have noted.

LFP has already been accepted by the stationary battery energy storage system (BESS) sector, where energy density tends to be a less decisive factor.

CEA said LFP outsold NMC among batteries sold by Chinese manufacturers, with its market share growing through the year: of 100GWh of lithium batteries used for EVs and ESS, 44% were NMC and the majority of the remainder LFP.

Wood Mackenzie said similarly that LFP’s advantages are making it an attractive option in both power and energy applications, over the more mature market technology of NMC.

Supply chain issues which have beset the battery market are not likely to ease during 2022, the group noted, particularly with EV demand rising in reaction to the rising price of oil and the ongoing raw materials commodity crunch. Nonetheless, many more new plant announcements are expected this year, Wood Mackenzie analysts said.

Nearly 80% of lithium-ion battery demand is coming from the EV market, Wood Mackenzie consultant Jiayue Zheng said, adding that zero-emissions transport policies rolled out in response to rising fuel costs is “causing demand for lithium-ion batteries to skyrocket”.

The market already encountered shortages last year, Zheng said, driven by a combination of rising demand and raw material prices.

For stationary energy storage, predicted by Clean Energy Associates to account for about 13% of the total lithium battery market’s demand by 2030, it will be a case of figuring out strategies to vie for battery supply with EVs or diversify their technologies to get around the problem.

One example could be sodium-ion. CATL, one of the first to produce LFP batteries at scale and a major supplier to the BESS industry, has backed sodium-ion technology as a possible alternative and committed to commercialising it.

Yesterday, Sweden-based sodium-ion battery tech company Altris said that investors in a EU9.6 million (US$10.6 million) Series A funding round had included European battery manufacturing startup Northvolt. Major India-based clean energy group Reliance New Energy has also invested in sodium-ion, buying Faradion, a UK sodium-ion battery company.