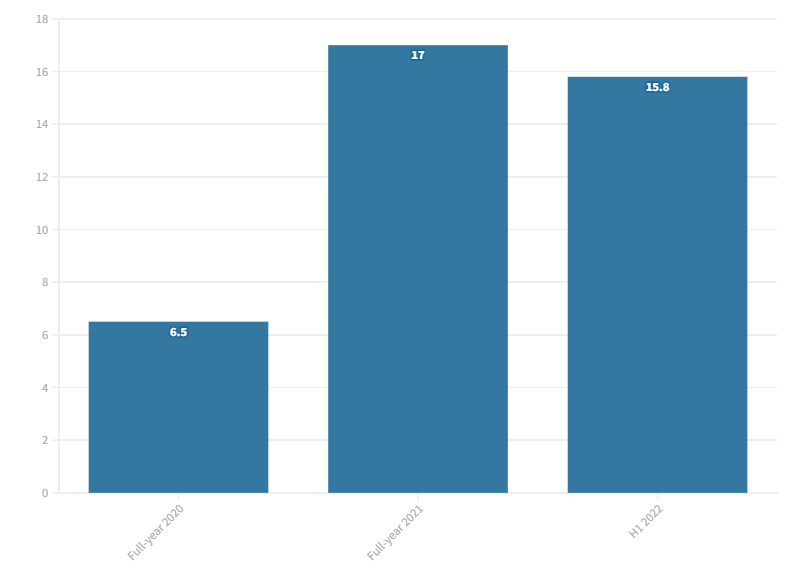

In the first half of this year, energy storage companies raised almost as much corporate funding as in the whole of 2021, according to Mercom Capital.

The latest edition of the market research group’s quarterly funding and M&A report for energy storage, smart grid and energy efficiency found that US$15.8 billion of corporate funding was raised in H1 2022 in energy storage.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

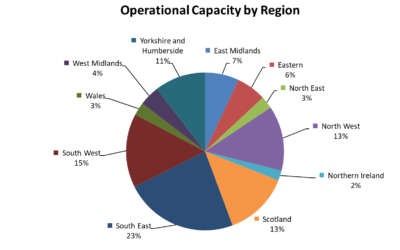

In 2021, that figure stood at US$9.6 billion at the half-year mark and at US$17 billion at the end of the year. That annual sum had been a 159% increase over the previous year’s pandemic-depressed US$6.5 billion and was the highest recorded since 2014.

With Mercom CEO and lead analyst Raj Prabhu having said in January that 2021 was the first year in which “funding activity reflected the significance of battery energy storage in the energy transition,” this year is on track to be bigger.

That said, Q2 was relatively quiet after a strong first quarter. Of the US$15.8 billion half-year total for 2022, US$12.9 billion was recorded in Q1.

A trend Mercom noted this time out was that the profile of investors is shifting from venture capital (VC) to increasing shares of public and debt financing, with several energy storage companies having listed publicly in the past year or so.

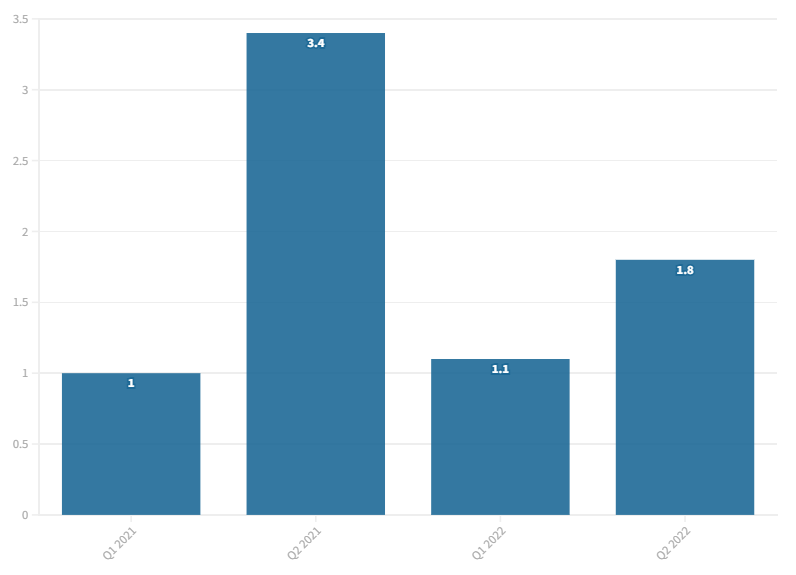

VC funding in the energy storage sector in H1 2022 was down 34% year-on-year against the same period of 2021, at US$2.9 billion across 45 deals versus US$4.4 billion from 34 deals. There was a quarter-on-quarter increase from US$1.1 billion in Q1 2022 across 21 deals, to US$1.8 billion in Q2 of this year from 24 deals, but again, compared to US$3.4 billion across 20 deals in Q1 2021 was a significant drop.

Mercom – which appears to use the terms ‘energy storage’ and ‘battery storage’ somewhat interchangeably in its reporting – said that there is a wide diversity of technologies and companies raising funding. These include lithium-ion battery companies, fuel cells, compressed air energy storage, zinc-based batteries, flywheels and many other technologies classifiable as energy storage, or more loosely, battery storage.

Energy storage and renewable energy investor Eolian raised US$925 million VC funding during the reported period, making it the single biggest dealmaker in the sector. Eolian got funding from investors including major banking groups MUFG and Banco Santander and its portfolio includes the development pipeline of an energy storage developer it acquired, Able Grid.

In second place was Group 14 Technology a group developing and commercialising advanced lithium-silicon batteries, while in third place was advanced compressed air energy storage (A-CAES) company Hydrostor, which raised a long-term US$250 million investment commitment earlier this year from Goldman Sachs Asset Management.