Microvast, a Texas-headquartered company manufacturing battery cells and battery storage systems, has won a 1.2GWh customer order to supply a battery storage project.

The order has come in from an undisclosed customer in the US with a utility-scale battery energy storage system (BESS) project.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

It has been announced just weeks after Microvast launched a dedicated energy division to capitalise on growing demand in the stationary energy storage market. The company has an established presence supplying the electric vehicle (EV) market, and offers NMC-1/NMC-2, LTO and LFP battery cells. It also has its own battery management systems (BMS).

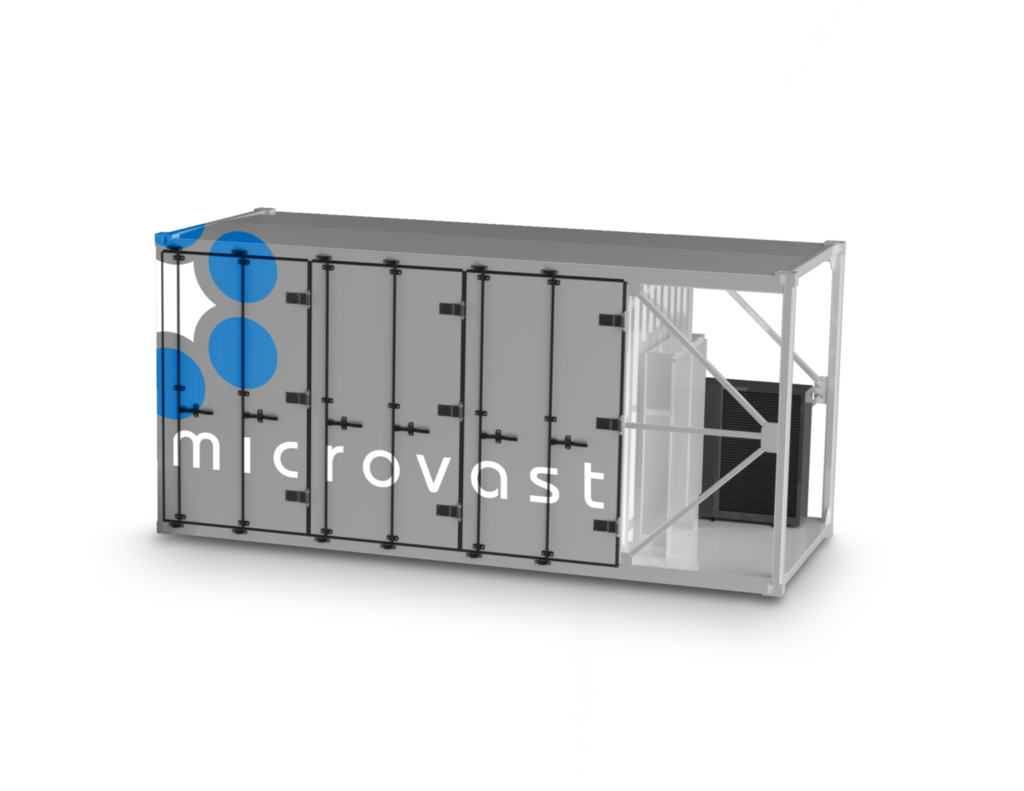

In October, the company launched its first containerised BESS solution. It has what Microvast claimed is an industry-leading capacity of 4.3MWh per container. For reference, a Tesla Megapack is 3MWh and a Saft Intensium Max about 2.5MWh, to name two examples from rival makers.

Microvast’s ME-43000-UL ESS Container is a 20ft, liquid cooled system, using the company’s 53.5Ah NMC cell technology. The cells have a claimed 235Wh/kg energy density and can achieve in excess of 10,000 cycles under normal operating conditions and are based on solutions proven in commercial vehicles.

The 1.2GWh BESS will be co-located with a solar PV project. Shipments of the ME-4300 containers should start arriving at the project site next year, for commercial operation to begin during 2024.

With the US having passed the Inflation Reduction Act (IRA), the legislation including a US$369 billion package of support for clean energy and climate crisis mitigation measures, there’s a strong push to buy and use domestically produced equipment, which is incentivised through the act.

As noted earlier in the week on Energy-Storage.news, since the IRA was passed, there has been twice the level of investment committed to lithium battery gigafactories in the US as in Europe. According to battery market intelligence firm Benchmark Mineral Intelligence, Europe remains on pace to lead the US in capacity, but the IRA, as well as high energy costs in Europe, appear to have closed the gap a little.

For instance, LFP manufacturing startup American Battery Factory (ABF) just announced the planned location of its first gigafactory, and another, Kontrolmatik, a few days ago said that it expects it could get around US$900 million in IRA incentives to build its own 3GWh LFP factory in the country.

Microvast said that its cells, made at a site in Clarksville, Tennessee, will qualify as domestic content, being eligible for full IRA tax incentives.

“The anticipated volume from this project will utilise a significant amount of capacity at our battery cell manufacturing facility in Clarksville, Tennessee and it is expected to be one of the first projects in a robust pipeline of grid-scale energy storage projects to incorporate battery cells manufactured in America,” Microvast chief operating officer Shane Smith said.