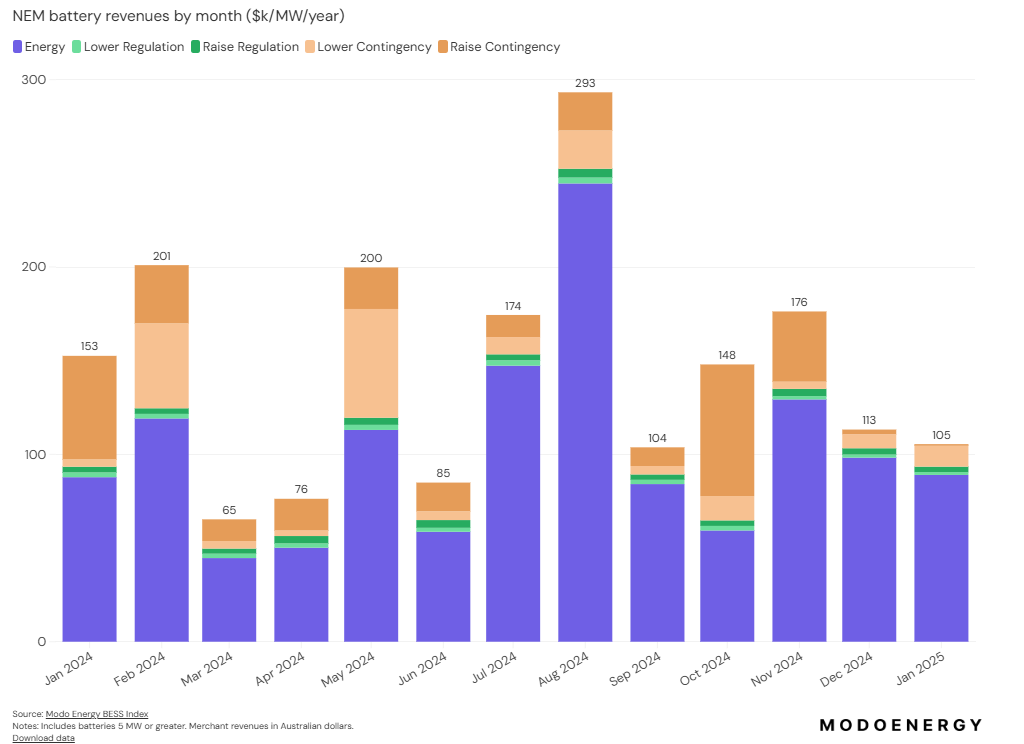

Modo Energy has said that revenue for battery energy storage systems (BESS) in Australia’s National Electricity Market (NEM) fell by 7% month-on-month in January, despite revenue tripling in Queensland.

According to the Modo Energy NEM BESS Index in January 2025, BESS revenues stood at an average of AU$105/MW/year (US$67/MW/year), slightly lower than the AU$113/MW/year recorded in December 2024.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

UK-headquartered battery storage market intelligence provider Modo recently launched its Australia service, complementing similar benchmarking and data services for the UK and the ERCOT market in Texas, US.

More alarmingly, this is 29% below the 2024 average of AU$149k/MW/year and a 31% year-on-year decrease on the AU$153/MW/year recorded.

This month-on-month decrease has been attributed to the high revenues from raise contingency Frequency Control Ancillary Services (FCAS) in December. Modo said energy trading continued to be the dominant stream for merchant revenues. In January, 84% of revenues came from energy trading, 12% from contingency FCAS, and 4% from regulation FCAS.

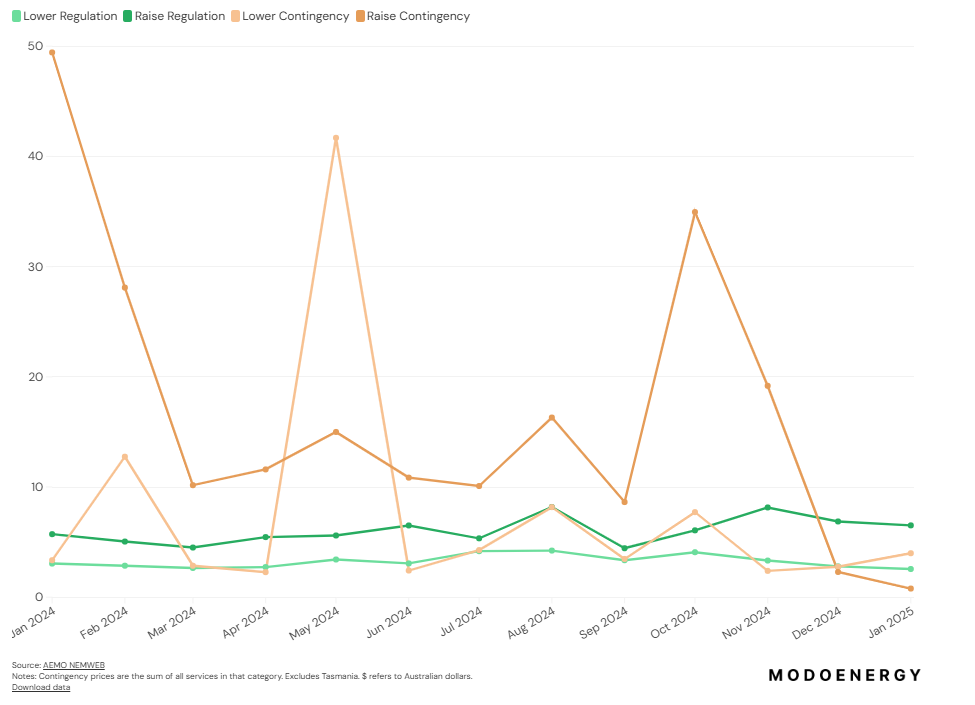

As seen in the graph above, a decrease in raise contingency is the main reason for the year-on-year drop in 2024’s levels. In January 2024, raise contingency was an average of AU$55/MW/year, whereas in 2025, it slid drastically to just AU$1/MW/year.

An example of a raised contingency occurs when a generator trips unexpectedly, allowing batteries to quickly discharge and support grid frequency, thereby earning revenue for providing this immediate assistance. On the other hand, a lower contingency occurs during periods of sudden excess generation. In this case, batteries are able to absorb surplus energy and help lower the frequency while earning payments for this service.

Modo noted in its research that the decrease in raise contingency occurred due to reduced Raise 1-second FCAS prices. 1-second FCAS was introduced in October 2023, and as the 1-second FCAS market has matured, raise 1-second FCAS prices started to drop in February 2024 and have continued to do so. You can find the changes in lower and raise contingency in the graph below.

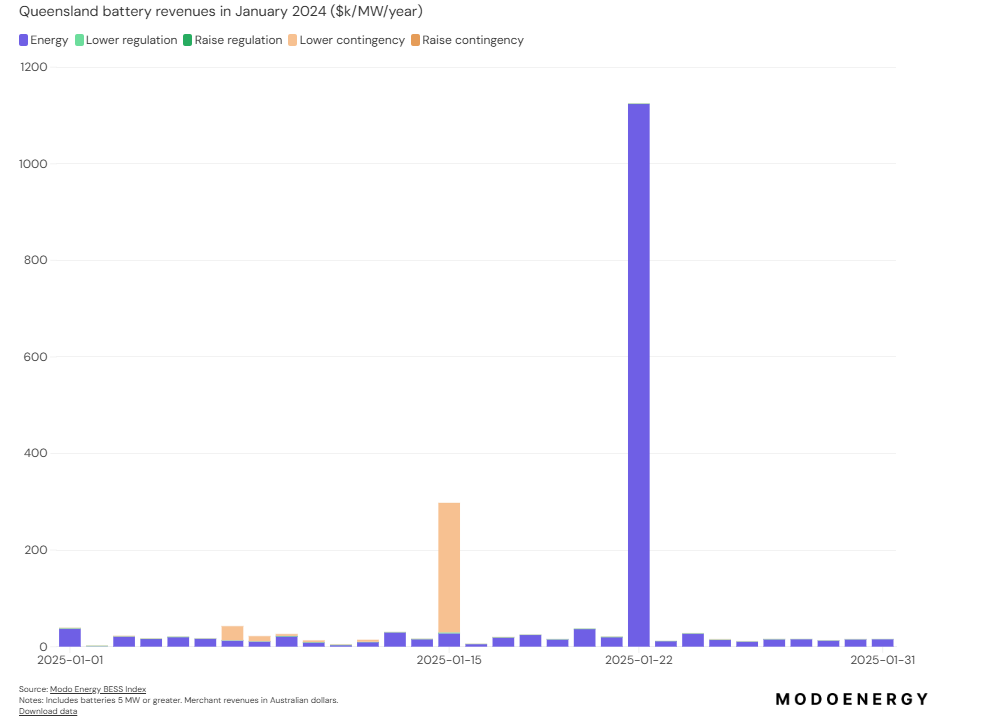

On 15 January, lower contingency prices in Queensland spiked, with lower 60-second FCAS prices exceeding AU$10,000/MWh for one hour. However, the monthly average did not rise significantly, as the price surge occurred in just one state and lasted only for that hour.

Queensland BESS revenue five times higher than other NEM states

Despite the lower revenues, Queensland’s BESS had the most lucrative month of all the NEM states, with revenue being more than five times higher than the average from the other Australian states, thanks to the aforementioned price spikes.

Queensland battery revenues increased by 30% from December to AU$277k/MW/year in January. This was over five times higher than the average revenue for batteries in the rest of the NEM, at AU$53k/MW/year. Modo said this outperformance was due to more periods of prices above AU$10k/MWh in January than in December.

On 22 January, extreme pricing enabled batteries in Queensland to generate substantial revenues from energy trading, earning 57% of their total monthly income on that single day.

On this day, batteries made over four times the revenue compared to their second-highest earning day on 15 January, when the FCAS Lower 60 Second prices spiked in Queensland.

Elsewhere in Australia, New South Wales saw the largest drop in average revenue to AU$47k/MW/year in January, 77% lower than the earnings of AU$205k/MW/year recorded in December 2024.

Alongside Queensland, BESS in Victoria also saw a rise in revenue, around 19% more than in December. However, Victoria’s revenues for both months are still lower than the NEM average due to the state’s lack of extreme prices.

In January, energy prices in Victoria did not exceed AU$480/MWh, and in December, they did not exceed AU$769/MWh. Modo said this meant the state continued to see the lowest price spreads of the four mainland NEM regions.

Longer-duration systems see increased revenue

Earlier this month, Modo Energy revealed that the top five best-performing BESS assets on the NEM in 2024 included Bouldercombe, the 25MW/52MWh Lake Bonney BESS in South Australia, TransGrid’s 50MW/75MWh Wallgrove battery in New South Wales, Shell’s 60MW/120MWh Riverina 1 BESS in New South Wales, and the 100MW/150MWh Wandoan South BESS in Queensland.

Each of these systems is also longer in duration than average. Bouldercombe, Lake Bonney, and Riverina 1 are two-hour systems, while Wallgrove and Wandoan South are 1.5-hour duration. In general, the longer a battery’s duration, the higher its revenues in 2024, Modo said.

A rise in revenue for longer-duration systems coincides with previous research conducted by Wood Mackenzie, which said last year that 4-hour battery systems would be more profitable in the future than the typical 1.6-hour duration of projects operating currently.

Wood Mackenzie’s research outlined that a 4-hour battery that starts operations in 2026 is projected to generate an average annual revenue of AU$263,000/MW over its lifetime. Batteries in Queensland are expected to lead at AU$281,000/MW.

Previous research by Modo indicated that the capital expenditure (CAPEX) for 4-hour batteries is expected to decrease by 20% by 2030, making investments in this technology more economically attractive.

Wendel Hortop, director of Australia at Modo Energy, exclusively spoke with ESN Premium about the trends in the NEM and how one day in 2024 accounted for 11% of the entire average revenue.