NEC has now executed five grid-scale battery energy storage projects in China and been awarded another, winning deals in spite of what a company representative described as “aggressive” price competition from domestic vendors.

The Massachusetts-headquartered distributed energy division of the Japanese NEC Corporation, NEC Energy Solutions, has commissioned two 9MW projects in Ordos City, Inner Mongolia and at Tanshan City, Heibei Province, to deliver frequency regulation at existing power plants, for client Ray Power.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Ray Power has a business model of combining energy storage systems (ESS) at coal power plants in China for delivery of ancillary frequency regulations services. The company has also awarded NEC a further 6MW project in Shanxi Province, for completion in mid-2019.

The two 9MW projects already commissioned follow an automated generation control (AGC) signal from the grid to inject or absorb energy in order to regulate frequency. By using energy storage as a standalone, or combined with existing power plants, frequency regulation can be provided more efficiently and with less thermal plant run time than it can be with coal power stations, which have traditionally been used to provide the service in many regions of the world. While the ESS projects are not directly paired with renewables therefore, the implementation of better frequency regulation services is often an enabler of higher penetrations of renewables elsewhere on the grid.

All of NEC’s projects in China have come about through its exclusive distribution partner into the country, Puxing. Puxing is itself a subsidiary of Chinese multinational Wanxiang Group. Wanxiang Group was in fact the original owner of A123, the EV battery and energy storage company from which the stationary storage division was spun out, bought up by NEC and relaunched as NEC Energy Solutions. NEC has worked exclusively with Puxing since that acquisition deal in 2014.

China expected to be ‘largest regional market in the world’ for ESS

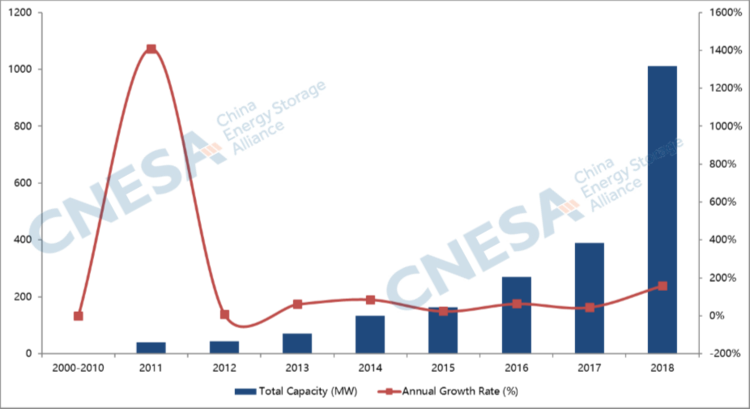

Recent reports from the national China Energy Storage Alliance (CNESA) said that electrochemical energy storage deployed in the country increased 104% year-on-year by the end of September 2018, with 649.7MW installed cumulatively. During the one-year period leading up to then, 260.8MW was installed, a 373% year-on-year increase. The Chinese government has also issued supportive policies and roadmaps for promotion and integration of energy storage, including “Guiding Opinions on Promoting Energy Storage Technology and Industry Development”.

“Whether behind-the-meter or front-of-the-meter, energy storage has earned status as an independent market entity,” Chen Haisheng, China Energy Storage Alliance Chairman and Deputy Director of Chinese Academy of Sciences Institute of Engineering Thermophysics, wrote.

NEC’s director of marketing for Energy Solutions Roger Lin told Energy-Storage.news on Monday that the six projects executed to date with Ray Power are “improving the business case for power plants” in China.

“We expect China to be the largest regional market in the world for energy storage over the next few years,” Lin said.

“While frequency regulation will continue to make advances, the larger market will be driven by renewable integration applications as China begins to wean itself from coal, and storage performing peak or time shifting of energy.”

Lin mentioned that NEC’s emphasis on safety was a key part in winning the company contracts in China, claiming that “our track record on safety has gone a long way in securing new business”. In some ways, he said, NEC has laid down the gauntlet for low-priced competitors in the market.

“This [our approach] is somewhat at odds with the aggressive pricing in the Chinese market, challenging the industry to ensure safe product while at the same time offering low prices,” Lin said.

“Puxing Energy collaborated closely with NEC Energy Solutions to deliver excellent energy storage solutions to Ray Power. The commissioning and commercial operations of these projects have demonstrated once again the safety and reliability of NEC ES’s systems that customers have come to expect. We are happy to continue working together with NEC ES to implement energy storage across China,” Puxing Energy CEO Junyong Wei said.