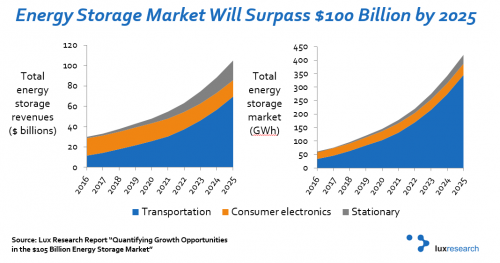

As early as next year, demand for energy storage in consumer electronics could be overtaken by markets for electric mobility and stationary energy storage, Lux Research has forecast.

To date, the market for energy storage, mostly in the form of electrochemical lithium-ion batteries has been largest in supplying batteries for smartphones, laptops and other consumer goods. However, the twin accelerating markets for renewable energy integration and plug-in electric vehicles (EVs) could outstrip this demand as early as 2018, the Boston-based research and analysis firm has claimed.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

According to analyst Chris Robinson, lead author of a new report, Quantifying growth opportunities in the $105 billion energy storage market: “The emergence of plug-in vehicles from Tesla and its competitors will reshape the energy storage market, while increasing renewable deployments will make stationary storage energy another source of growth.”

Robinson said technology in energy storage had advanced greatly in recent years, benefitting consumer electronics and other applications for batteries alike.

The total energy storage market will be worth US$100 billion by 2025, Lux predicted, with around US$69 billion market value for the transportation sector. While stationary storage will be a smaller market, with US$19 billion revenues predicted for that year, Robinson and team said it will be the fastest growing sector to demand high volumes of energy storage. By 2025, stationary energy storage will add up to 34GWh of demand, Lux’s forecasts state, with highest demand growth in India and China. Long duration storage in particular is expected to see demand increase.

This year, consumer electronics’ demand for energy storage will constitute around 27GWh, dwarfed by the anticipated 46GWh of energy storage demand for transport. The consumer electronics market will nonetheless grow, at a rate of about 6% a year, but rapidly declining battery prices mean revenues will remain relatively flat, according to Lux.