Berkshire Hathaway Energy-owned utility PacifiCorp is planning to install 3,073MW of iron-air battery storage by 2045.

The utility has filed its 2025 integrated resource plan (IRP) with the six state utility commissions in its service area. The IRP included the novel technology developed by startup Form Energy and designed to deliver up to around 100-hour duration energy storage in its preferred resource portfolio mix.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

PacifiCorp services areas of California, Washington, Oregon, Idaho, Wyoming and Utah, US.

The company’s 2025 IRP shows a need for investment in:

- Transmission infrastructure — Upgrades and new investments for increasing energy transfer capabilities in the Intermountain West and Pacific Northwest service areas.

- Renewable solar resources — Installing 2,092MW of utility-scale solar by the end of 2030, increasing to 4,765MW by 2045. Additionally, the plan includes 320MW of new small-scale solar for Oregon by the end of 2030, rising to 1,157MW by the end of 2045.

- Renewable wind resources — Installing 2,267MW of new wind generation by the end of 2030, increasing to 3,782MW of cumulative new wind capacity by 2045.

- New energy storage — This includes 1,634MW of 4-hour storage from batteries, and 605MW of 100-hour iron air battery storage by 2032, increasing to 3,073MW by 2045. The total energy storage capacity of both types is anticipated to be 7,524MW by 2045.

- Conversion of coal-fueled generating units to natural gas — Conversion is anticipated to occur as required by US Environmental Protection Agency (EPA) greenhouse gas regulations under Section 111(d) of the Clean Air Act.

- Significant demand response and energy efficiency programmes — Creating programmes that help customers manage their energy efficiently and save money on their bills. Cost-effective programmes reviewed by regulators will seek to deliver 610MW of energy efficiency from 2025 through 2028 and 83MW of demand response between 2025 through 2028.

- Carbon capture technology — Evaluating the feasibility of carbon capture technology on Bridger Units 3 and 4 to comply with Wyoming state requirements.

PacifiCorp currently has an existing 523MW of standalone energy storage project. Six of the seven total projects are located in Utah, with one located in Oregon at the Oregon Institute of Technology (OIT).

The utility has an additional 550MW of energy storage co-located with solar facilities and available through power purchase agreements (PPAs).

Notably, PacifiCorp aims to add 605MW of 100-hour iron air battery storage by 2032 and 3,073MW by 2045.

The utility’s IRP includes iron air battery data provided by Form Energy, which is looking to commercialise a proprietary battery technology based on ‘reversible rusting’.

PacifiCorp’s 2025 IRP notes that 100-hour iron-air storage has a low capital cost with a low round trip efficiency.

The utility mapped out multiple scenarios of possible outcomes for its IRP, seeing iron-air energy storage as a valuable asset in its portfolio.

From the IRP:

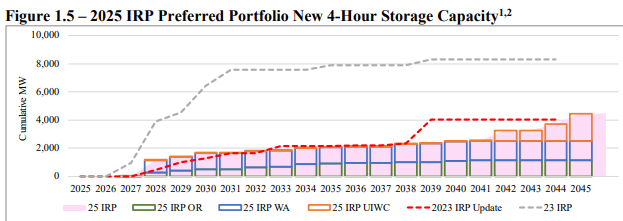

“New storage resources in the 2025 IRP preferred portfolio are summarized in Figure 1.5 and Figure 1.6. The 2025 IRP preferred portfolio includes 1,684MW of new 4-hour storage resources by the end of 2030, 2,072MW by the end of 2035 and 4,451MW by the end of 2045.”

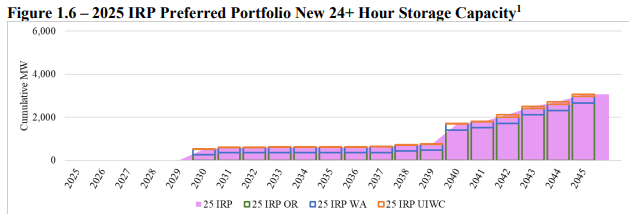

“Additionally, the 2025 IRP preferred portfolio includes 511MW of 100-hour iron-air storage by the end of 2030, 616MW by 2035 and 3,073MW by 2045. Total storage selections, inclusive of both 4-hour and 100-hour resources, include a total of 7,524MW of new storage.”

In 2024, Form Energy closed a US$405 million Series F funding, which included investors such as Bill Gates’s Breakthrough Energy Ventures.

Form has also opened a factory in West Virginia, for which state senator Joe Manchin announced that the company would receive up to US$150 million from the US Department of Energy’s (DOE) Battery Materials Processing and Battery Manufacturing and Recycling programmes in September 2024.

PacifiCorp is also exploring carbon capture technology when such projects, as reported by Reuters, are slated for cuts from the DOE.

The DOE is reportedly considering cutting billions of dollars in funding for new energy storage and carbon capture projects. Currently, the cuts would most heavily affect California, Texas and North Dakota.

At the beginning of the year, the DOE’s Loan Programs Office (LPO) announced a conditional commitment of US$3.52 billion to PacifiCorp for building and reconductoring transmission lines.

This loan and many others were left unfinalised before the start of US president Donald Trump’s second term in office.

Thus far, the LPO has provided financing to nuclear power projects and a project for a sustainable aviation fuel plant.

Between the LPO’s activity and the DOE considering these cuts, the future of PacifiCorp and others’ loans is uncertain.