Potentia Energy, a joint venture co-owned by Enel Green Power and INPEX, is set to secure several battery energy storage system (BESS) assets across Australia as part of a 1.2GW portfolio acquisition.

The portfolio will be acquired from infrastructure investor CVC DIF. It comprises 700MW of solar PV and wind assets across multiple states and the Australian Capital Territory.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

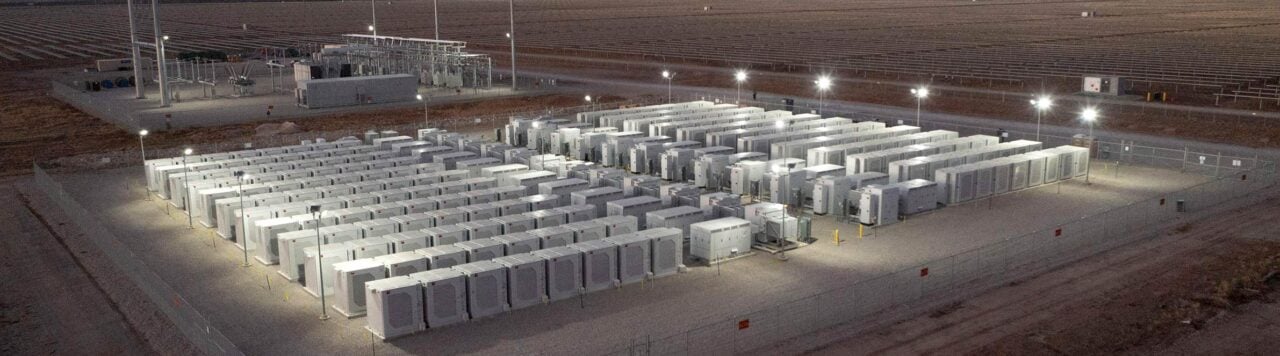

It also includes 430MW of late-stage developments, including South Australian and Queensland BESS assets and a Western Australian wind project that recently achieved financial close.

Several wind and solar PV assets will also be secured via an interest in Bright Energy Investments, a developer, owner and operator of enterprise-scale renewable energy generation assets. This is via a deal with Cbus Super, a superannuation fund.

This includes the 40MW Greenough River Solar Farm in Western Australia, the 20MW Royalla Solar Farm in the Australian Capital Territory, the 100MW Clare Solar Farm in north Queensland and the 275MW Bungala Solar Farm in South Australia.

The specific BESS assets that Potentia Energy are set to secure have not been named.

Werther Esposito, CEO of Potentia Energy, formerly known as Enel Green Power Australia, before its rebranding in December 2024, said the strategic acquisition affirms the company’s growth strategy for Australia and support by its shareholders.

“We are incredibly pleased to announce our acquisition of a portfolio diversified across geographies, technologies and energy markets, including both operational and development stage projects,” Esposito said.

“The acquisition expands and complements our existing portfolio of solar and wind assets across the Wholesale Energy Market (WEM) and National Electricity Market (NEM).”

To read the full article, please visit our sister site PV Tech.