Grid limitations can impact the business case for battery storage assets for a number of reasons, writes Amira Belazougui of Clean Horizon.

As the energy landscape transitions towards renewable energy sources, battery energy storage systems (BESS) have become essential for grid stability.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, the increasing demand for energy storage and renewable energy generation to replace thermal capacities is placing pressure on existing infrastructure, leading to grid limitations that significantly impact BESS operations and financial viability.

What are grid limitations?

Grid limitations arise when energy assets, particularly BESS, face constraints due to insufficient electrical infrastructure. As renewable energy systems, such as wind and solar, continue to expand, grid operators are struggling to deal with energy generation flows.

Given that consumers and renewable sources have the priority for grid access, operators are often forced to curtail other assets, including energy storage systems.

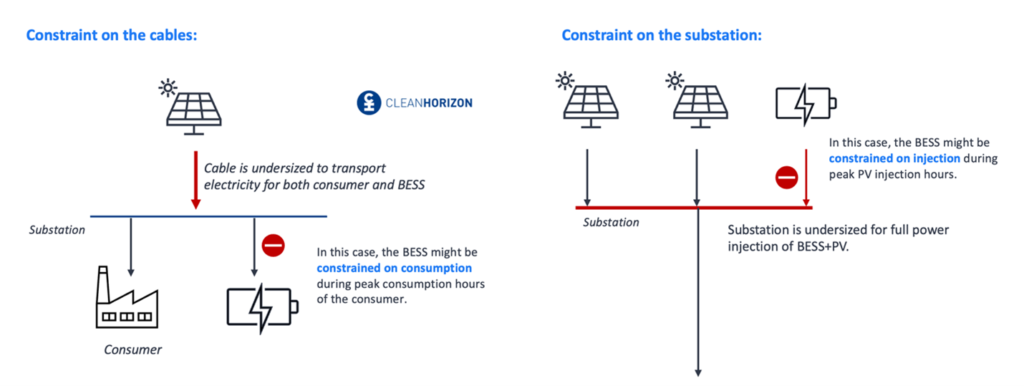

These limitations can occur in two cases:

- If a battery shares infrastructure with a consumer, such as a cable, the system may lack the capacity to handle both at peak consumption, leading to restrictions on the battery’s consumption.

- When power plants, like solar farms, and batteries are connected to the same substation, grid capacity may be insufficient to handle simultaneous peak power injections, causing the battery to stop injecting power when the solar farm is at full capacity.

Overall, the limitations appear due to a lack of or weakness in the grid infrastructure. These constraints can either be temporary (during grid reinforcement) or permanent, impacting an asset’s profitability throughout its lifetime.

Grid limitations can also be classified into two categories based on how they are implemented:

- Preventive Limitations: These limitations are pre-planned, with grid operators informing battery operators in advance (often a day before). This allows operators to adjust their strategies, minimizing the impact on their revenue.

- Curative Limitations: These limitations are unexpected and occur in real time due to unforeseen grid congestion or equipment overloads. The lack of prior notice makes curative limitations particularly challenging, as they can lead to significant revenue losses, especially for assets engaged in real-time energy markets or ancillary services.

Grid limitations across European countries

Grid limitations vary across different regions, with each country implementing unique practices for managing these constraints. For example:

- France: RTE Grid connection agreements specify the maximum number of hours an asset can be limited and the severity of those limitations. Operators receive information based on worst-case scenarios, allowing them to plan accordingly, although this can sometimes lead to overestimating the limitations.

- Germany: Like France, Germany provides grid connection agreements that outline the percentage of time during which limitations may apply, emphasising frequency rather than specific reductions in power output.

- Belgium: Belgium also uses a percentage-based limitation framework, typically based on worst-case conditions to ensure grid stability.

Despite their conservative estimates, these measures help avoid delays in asset connections and the need for costly infrastructure upgrades.

Although grid limitations from TSOs are often overestimated, a detailed grid study can provide a more accurate understanding of potential constraints. Operators can assess several factors to create a realistic business case:

- Evaluating the capacity of substations, transmission lines, and cables can help pinpoint potential bottlenecks that may lead to limitations.

- Forecasting the growth of renewable energy sources in the region helps anticipate curtailments, as renewable energy assets have priority for grid access.

- Weather patterns, particularly for wind and solar generation, affect grid constraints. Including weather variability in grid studies improves the accuracy of limitation predictions.

- Understanding regional consumption patterns, especially during peak demand periods, helps predict when grid congestion may occur.

By incorporating these factors, BESS developers can have more accurate scenarios for grid limitations, improving their ability to optimise BESS operations and reduce risks.

Impact of grid limitations on project finance

Grid limitations directly impact the revenue potential of BESS projects. When restrictions are placed on charging or discharging, it can significantly reduce the profitability of energy storage systems. For example, without limitations, a project may achieve an internal rate of return (IRR) of 13.9%. However, minimal constraints may reduce this by 0.5% to 0.7% based on the number of limitation hours, and severe limitations could lower it by as much as 2.5%.

The Clean Horizon Optimal Simulation of Market Operations for Storage (COSMOS) tool, designed to optimise the economic model of energy storage projects based on quantitative elements, can estimate these revenue losses due to limitations.

The timing and nature of grid limitations are crucial factors. Projects may face penalties if they fail to meet commitments due to sudden curtailments. If operators are given advance notice (e.g., two days), they can adjust operations and mitigate penalties by shifting strategies or finding alternative revenue sources.

Strategies for managing grid limitations

To address the challenges posed by grid limitations, BESS operators are employing various strategies:

- Shifting BESS operation to more flexible market segments, such as intraday markets, where they can adjust operations in real time. While this strategy may reduce potential revenue, it can help minimise the impact of grid constraints.

- Improving grid condition forecasts based on solar and wind generation patterns, operators can optimise asset performance and reduce the impact of limitations.

- Collaborative agreements between multiple projects can help balance limitations and ensure more consistent performance across assets, reducing the financial risks associated with individual project constraints. For instance, A pool of asset can prevent the operator to be subject to penalties by shifting the BESS activation obligation to another plant.

- As grid limitations can create uncertainty for investors and financiers, some route-to-markets offer revenue guarantees. Though the presence of grid limitations can diminish these guarantees, they can still help reassure investors by ensuring more reliable revenue streams.

Understanding and managing grid limitations is crucial for the success of BESS projects. By conducting thorough grid studies, and employing flexible operational strategies, operators can reduce the risks posed by grid constraints. As the energy sector continues to evolve, developing innovative strategies to navigate grid limitations will be critical for ensuring the bankability and profitability of energy storage projects.

About the Author

Amira Belazougui is a senior analyst at Clean Horizon, a consultancy which offers both market analysis and technical consultancy on energy storage. Her role involves assessing the financial viability of energy storage projects and conducting market analysis, notably focusing on the French market. Amira graduated with a degree in Electrical Engineering from École Polytechnique in Algeria. She also holds an additional master’s degree in Physics & Energy Engineering from CentraleSupélec, as well as a Specialised Master’s in Optimisation of Energy Systems from Mines Paris (France).