Integration of data analytics and asset revenue data will give battery storage operators an edge in the ERCOT market, Energy-Storage.news has heard.

Battery energy storage system (BESS) analytics provider TWAICE and market intelligence platform Modo Energy have partnered to offer customers in Texas’ main wholesale market and transmission grid service territory an integration of their two offerings.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

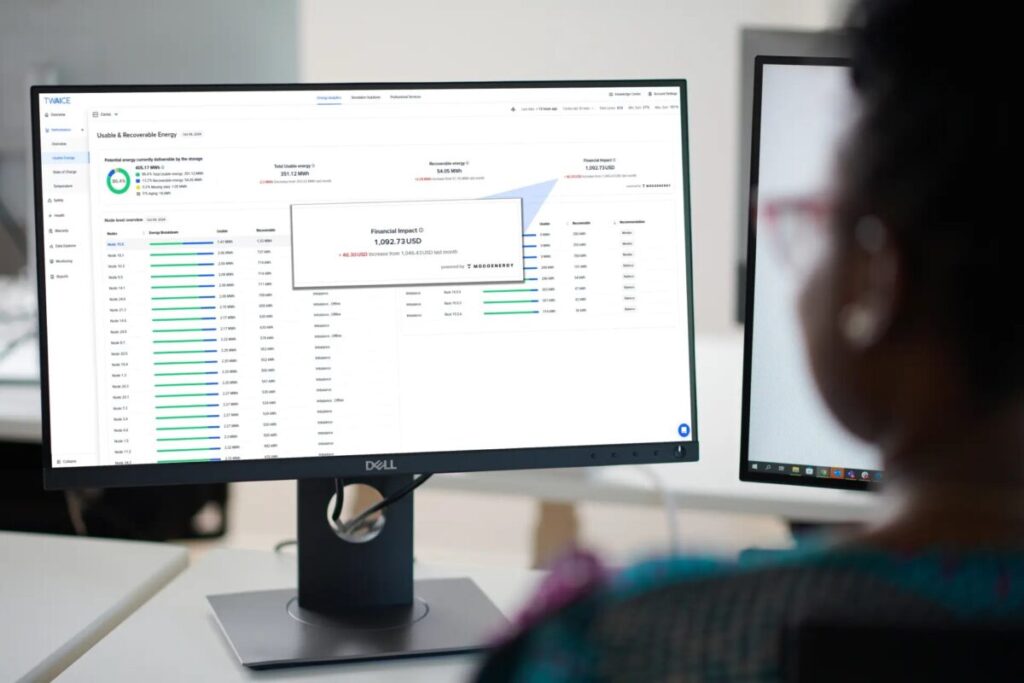

On the one hand, TWAICE provides operators insights into performance, safety and lifecycle metrics such as State of Charge (SoC), State of Health (SoH) of battery cells and imbalances across modules or underperforming or idle balance of plant (BoP) equipment such as inverters at the system level.

On the other, Modo Energy provides market data to its customers on how BESS assets are performing in merchant markets. This includes historical performance data of revenues earned by specific assets, as well as forecasting future revenues and benchmarking average revenues.

Launched in the UK first, Modo Energy is now also providing intelligence in Australia’s National Electricity Market (NEM) and ERCOT, with plans to move into key continental European markets.

Announced last week (25 March), TWAICE’s customers in ERCOT can now integrate Modo’s market data into a unified platform. The analytics provider claimed this can enable more accurate, asset-specific data calculation of revenues at the exact settlement point.

‘Technicians and asset managers must manage varying issues like lost capacity and revenue’

“Optimising asset performance in the highly competitive and dynamic ERCOT environment requires alignment among technicians and asset managers, who manage varying issues like lost capacity and revenue,” Ryan Franks, senior product manager for TWAICE, told Energy-Storage.news in an interview.

“The combination of data analytics and revenue benchmarking helps these teams align their strategies to capture opportunities ideal within ERCOT, such as maximising revenues from ancillary services or mitigating risk associated with extreme weather events or market volatility.”

In a July 2024 interview with ESN Premium, Modo’s ERCOT lead Brandt Vermillion said that beginning in 2022, the energy-only market, which provides around 90% of Texas’ grid-supplied electricity, had seen a much higher concentration of volatility in a smaller number of days (Premium access).

“That means an increase in volatility where prices are either going through the roof or batteries aren’t making much money at all,” Vermillion said.

Therefore, trading decisions made by operators or their route-to-market (RTM) optimisers become increasingly important, including whether to provide ancillary services or make arbitrage decisions on real-time or day-ahead energy trading arbitrage.

At the same time, operators need to know that their systems are available and capable of performing those charge-discharge cycles, and that is where analytics can step in, from estimating the charge of batteries to monitoring overall system performance.

TWAICE to publish ERCOT case studies later this year

Franks told Energy-Storage.news that using the two solutions separately has drawbacks.

“If TWAICE’s software and Modo Energy’s intelligence were used separately, a customer would need to manually copy the loss due to imbalances, weak cells, and ageing, and then look up market data to determine how much impact these issues have on revenue,” Franks said.

With the two platforms integrated, customers can monitor the impact of hardware issues on their ability to capture revenues in a central dashboard. Franks claimed this is especially valuable in ERCOT, where opportunities for making money often “rely on the immediate demands of real-time energy.”

TWAICE plans to publish its first real-world case studies on the impact of the integration later this year, according to Franks, who claimed Modo Energy’s benchmarking and forecasting tools are “ideal” for the analytics company’s ERCOT customers.

“Modo Energy is an invaluable resource for electricity market data in key markets like the United Kingdom, Texas and Australia, and their accessible API, combined with a strategic roadmap for expanding into new markets, made them a compelling choice for our needs,” he said.

Earlier this year, European RTM optimiser enspired began offering a direct integration of insights from another data analytics firm, Volytica, into its platform, in another example of the growing recognition of the value of battery data analytics solutions from companies including TWAICE, Accure Battery Intelligence and PowerUp.