The US Department of Energy’s (DOE) Loan Programs Office (LPO) has announced a conditional commitment for a loan of up to US$2.5 billion to Wisconsin Electric Power Company (WEPCO).

A subsidiary of Wisconsin utility WEC Energy Group, WEPCO submitted the loan application summer 2023. The loan would help finance more than 1,650MW of utility-scale renewable energy power generation and energy storage projects in the state.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Energy-Storage.news asked WEC Energy Group and WEPCO for comment regarding the distribution and financing of the projects potentially financed by the loan. A representative verified that the first project would be the rehabilitation of a hydropower facility but did not verify if this is the Big Quinnesec Falls hydropower facility mentioned in the DOE and LPO’s announcement.

Renewable energy generation and storage projects funded by the loan would go to assisting WEC Energy’s plans of eliminating coal as an energy source by 2032.

In October, WEC sought regulatory approval to split ownership of developer Invenergy’s two 150MW, 50MW/200MWh solar-plus-storage projects(Premium access article) located across the state.

This announcement from the DOE and LPO marks the first Energy Infrastructure Reinvestment (EIR) project under LPO’s flexible loan facility and disbursement approach. The approach is tailored for regulated, investment-grade utilities.

Borrowers for EIR projects must demonstrate that the financial benefits from the DOE loan will be passed on the customers served by the utility. LPO’s financing also comes with a lower interest rate, to help reduce upward pressure on electricity costs for WEPCO’s customers.

Additionally, EIR projects can be at different stages of execution, technologically diverse, and geographically varied, giving WEPCO more flexibility for utilising the funds, if finalised.

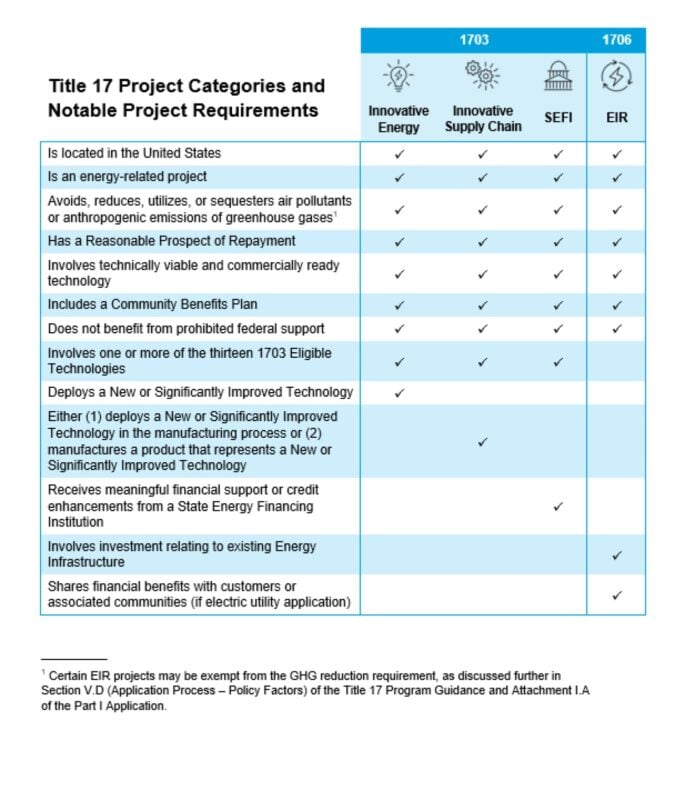

EIR projects must also involve investments relating to existing energy infrastructure. The provided chart shows the requirements that must be met for this project category.

Earlier this month, the DOE and LPO announced a conditional commitment to thermal energy storage startup Nostromo Energy subsidiary IceBrick Energy for a loan of up to US$305.54 million for the company’s IceBrick virtual power plant. This project met the requirements for the Innovative Energy category of LPO’s Title 17 Clean Energy Financing Program.

LPO performed an eligibility assessment and environmental review of the rehabilitation of WEPCO’s Big Quinnesec Falls hydropower facility. LPO confirmed the project met all program eligibility requirements for inclusion in the guaranteed loan facility.

Borrowers of the LPO are required to implement a community benefits plan (CBP), to ensure borrowers engage with community and labour groups to create good-paying jobs and improve the wellbeing of the community.

The CBP is important for a state like Wisconsin where coal plants were once vital to local economies. The closure and transformation of Wisconsin’s coal plants improves air quality by reducing particulate matter, but it also impacts the families who relied on the plants for employment.

WEPCO’s workforce is represented by collective bargaining agreements with the International Brotherhood of Electrical Workers (IBEW) and Utility Workers Union of America (UWUA). The DOE claims that at full deployment, these projects will help to support the creation of thousands of construction jobs and dozens of full-time positions.

Four of Wisconsin’s largest investor-owned utilities, including WEC Energy, pledged to use IBEW and other labour unions for renewable energy projects earlier this year. Adhering to standards from groups like the IBEW will help keep these positions competitive and local to the communities the projects are developed in.

This announcement continues the trend from the DOE and its LPO of soaring grant activity after Donald Trump’s second term election, as reported by Energy-storage.news(Premium access article).

In November city of Green Bay, Wisconsin commission members recommended approval for a Conditional Use Permit for a 200MW/800MWh large-scale battery storage project proposed by a subsidiary of Copenhagen Infrastructure Partners (CIP).