The US industry deployed 168MW / 288MWh of energy storage in the second quarter of this year, the second highest quarterly figures on record, according to Wood Mackenzie Power & Renewables.

The market research and analysis firm has just issued its latest quarterly US Energy Storage Monitor, produced in cooperation with the national Energy Storage Association industry group. The figures are up on Q1 2020’s 98MW / 208MWh of installations and are second only to the record-breaking final quarter of 2019, when 186.4MW / 364MWh of deployments were made.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Wood Mackenzie noted that one single grid-scale project in California made up two-thirds of the total deployments for the quarter: the state is leader in all three segments of the US market, from front-of-meter (62.5MWh in Q2), residential (66.1MWh) to non-residential including commercial and industrial behind-the-meter (32.1MWh).

Other states to lead the market segments included Hawaii (26.2MWh residential and 15MWh non-residential), Massachusetts (23.7MWh non-residential and 14MWh front-of-meter), Oklahoma (20MWh front-of-meter) and Arizona (3.5MWh residential).

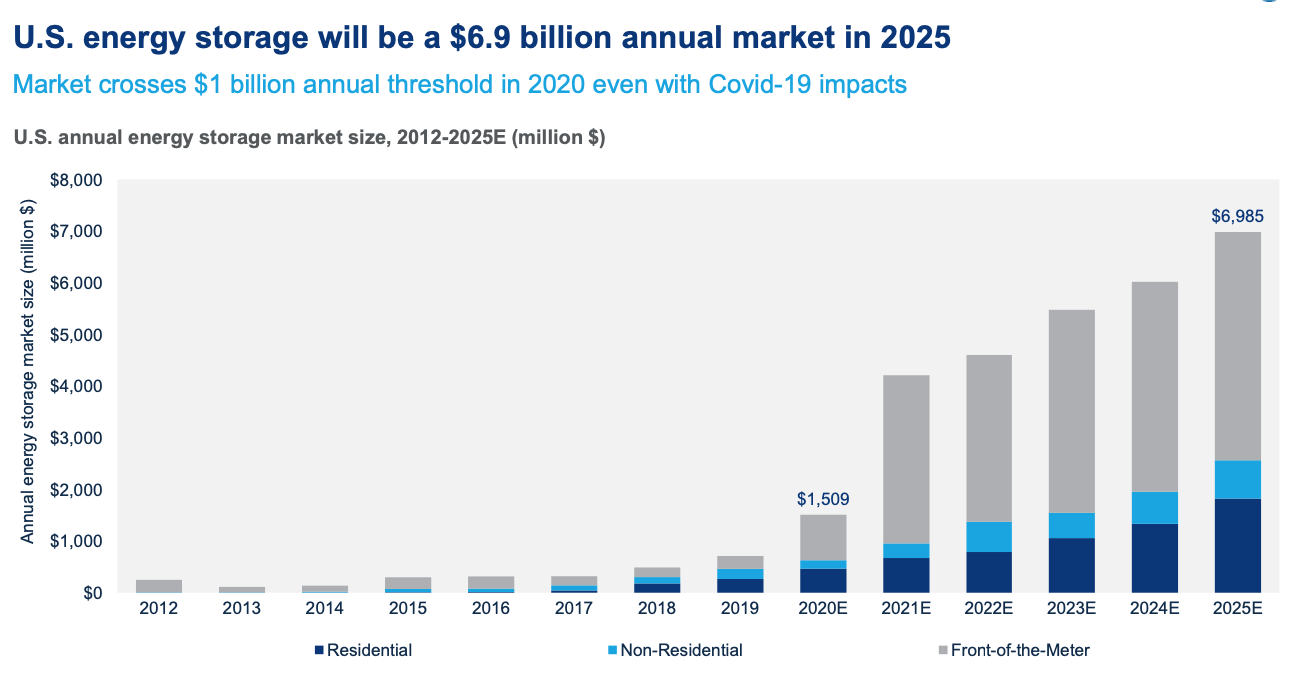

Firm revises annual deployment forecast downward slightly

While Wood Mackenzie had earlier in the year issued a forecast for the annual market to total 7.2GW in size and US$7.2 billion in monetary terms by 2025 in the US, the latest Monitor predicts that US deployments will reach “nearly 7GW” annually by 2025, worth about US$6.9 billion.

Nonetheless the growth forecast is still a significant jump from the 1.2GW of expected installations in 2020, which the analysis firm pointed out still meant the market crossed the US$1 billion threshold despite the COVID-19 pandemic’s impacts.

“The US energy storage market has proven remarkably resilient to impacts from coronavirus lockdowns. The commercial and industrial (C&I) space was the only segment that showed a slowdown,” Wood Mackenzie head of energy storage Dan Finn-Foley said.

“This was primarily because of a decline in the C&I California market due to permitting and other delays. We expect the rest of the year to come in strong as growing interest in residential storage, emerging new markets for C&I and massive front-of-the-meter (FTM) systems are set to break quarterly records.”

Deployments are expected to “spike dramatically in 2021”, due to large-scale utility procurements, including Southern California Edison’s 700MW+ announced in May and activities for various other utilities across the country as well as developers that capitalise on opportunities in wholesale markets and incentives in key markets. Front-of-meter will remain the largest segment of the market, accounting for around 83% of all installations in 2021.

While the market continues to grow – albeit with a risk of delays to permitting, construction and customer acquisition caused by COVID-19 continuing somewhat into the third and fourth quarters of the year – the Energy Storage Association has recently issued an “expanded vision” of 100GW of new energy storage being deployed by 2030 to support the US’ energy transition to renewables and more efficient energy resources while boosting system reliability and doing so cost-effectively.

ESA CEO Kelly Speakes-Backman commented that the association has been “encouraged” by the sector’s growth in the second quarter, and that “despite any setbacks from the coronavirus pandemic, the market for energy storage is poised to see significant growth in 2020”.

“Looking out to future growth, we are confident that our expanded vision of 100GW of new energy storage by 2030 is entirely reasonable and attainable, pushing us closer to reaching a more resilient, efficient, sustainable and affordable electric grid.”